For observers of the Indian Insurtech space, 2020 began on an eventful note with the regulator IRDAI announcing the list of ideas that were approved for implementation under the Regulatory Sandbox approach. A majority of approved ideas involve use of data and technology to offer differentiated solutions. Approved ideas include several in the area of Pay-as-you-Drive, Floater Motor policy and Wearable based Health insurance. The good number of proposals submitted (173) and approved (33) across Motor and Health Insurers highlights intent players to innovate, differentiate and push the envelope.

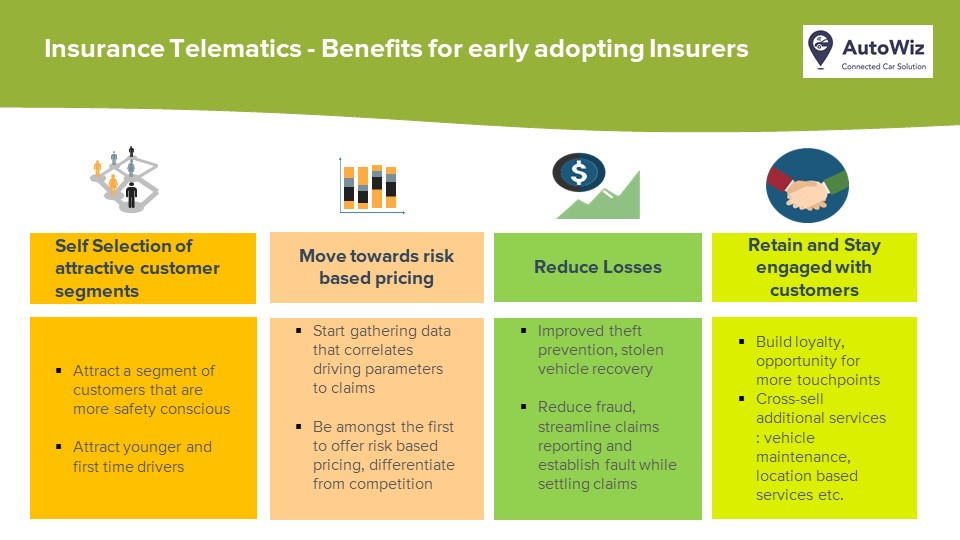

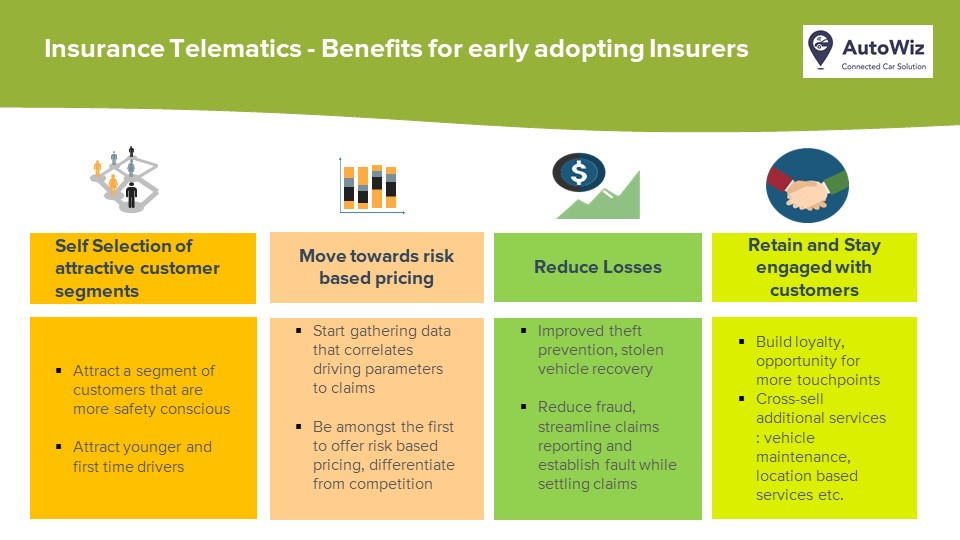

From our conversations in the area of Telematics Insurance space, we see increased interest from Insurers in evaluating Usage based Insurance approach for Indian market. While significant challenges remain (more on this below), there is a recognition from several Insurers that there are benefits of being an early mover or a fast follower in this space, and start collecting data that would enable creation of UBI products down the road. Some of the advantages of UBI are well known and also proven in other similar geographies where UBI has been around for a while.

Addressing the Telematics Cost Challenge

At the same time, there are adoption barriers for large scale UBI deployment in market like India. The most pervasive challenge is the cost of Telematics and does the existing Own Damage Premium pricing dynamics in the Motor Insurance space leaves room for an Innovator to bear the additional cost. And how does one balance the equation of increased cost of the technology at the same time yielding increased benefit for both the Insured and the Insurer. There is global evidence to support the fact that increased use of Telematics can lead to both lower premiums for safe/occasional drivers as well as lower loss ratios/higher customer retention for the adopting Insurers, thus resulting in an economic surplus that covers the cost of technology. However, the real test will be on ground and experiments such as Sandbox would hopefully enable some of that evidence to emerge.

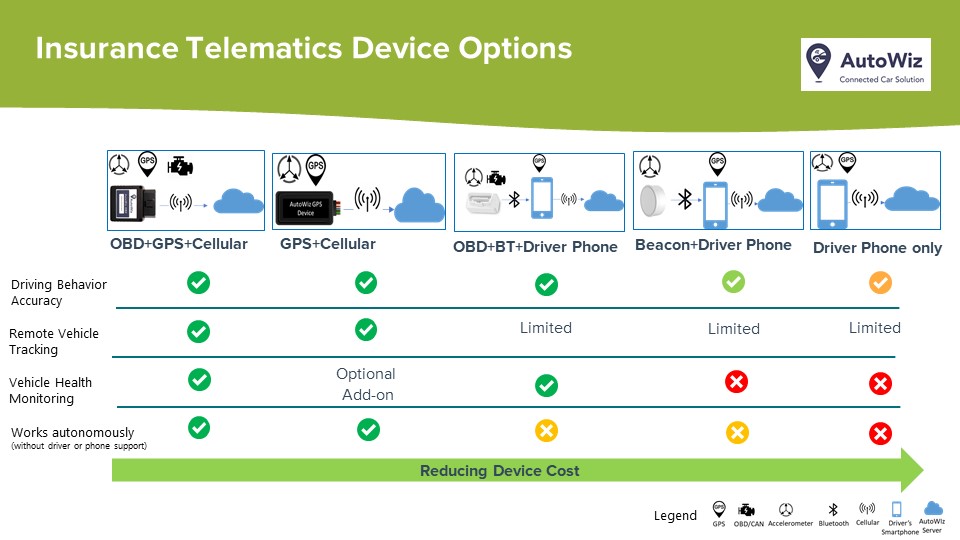

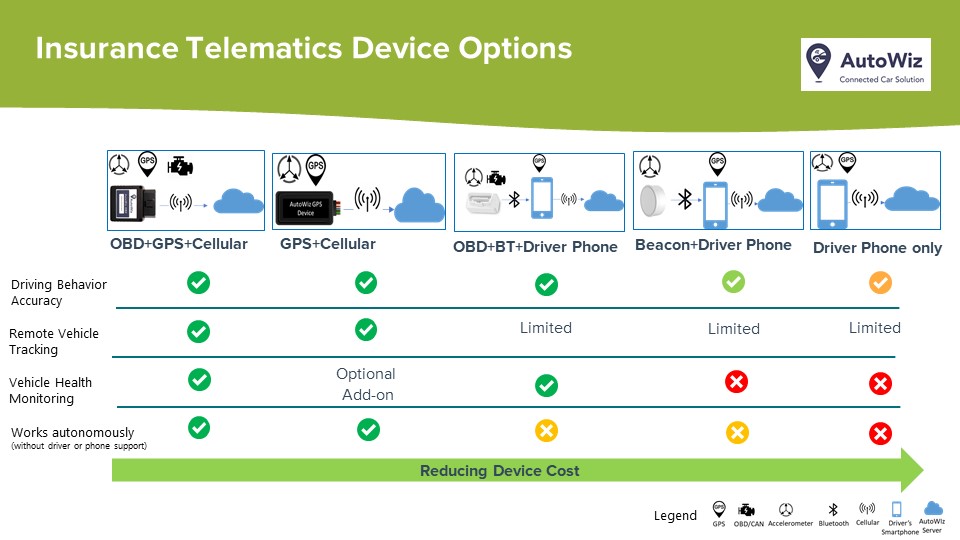

As a Telematics Solution Partner, we at AutoWiz, have taken a hard look at the Telematics technology options we offer to Insurers. We now offer options at various price points that meet both their data gathering, customer privacy and cost objectives. The solutions now go all the way from OBD-GPS connected devices (autonomously connected using cellular connections) to low cost sensor enabled BLE beacons that can be placed non-intrusively in the vehicle but rely on Driver’s phone to push data to cloud.

Our goal is to enable this new wave of experimentation in the Insurance sector with innovative and affordable Telematics Insurance technologies, that are tailored to work in our country.

For folks from Insurance industry, hear more about our viewpoint on Telematics Insurance at the International NIA-Swiss Re Seminar on 7th Feb in Mumbai where we talk on the Topic “Emerging Technological Trends and Implications on Insurance Business”.

Here is wishing everyone a great 2020 ahead.