Oct 8, 2021

In our conversations with Auto Insurers, certain questions on Telematics Insurance come up quite often. Here we list the top 5 questions, our view on these and how AutoWiz Telematics Insurance solutions address these.

In our conversations with Auto Insurers, certain questions on Telematics Insurance come up quite often. Here we list the top 5 questions, our view on these and how AutoWiz Telematics Insurance solutions address these.

1. Which Technology option should I choose for capturing Telematics data? Should I use OBD (or any other telematics device in vehicle) or Driver’s Smartphone?

Our short answer is that it depends upon the type of Usage Based Insurance (UBI) Program and the targeted customer segment. For Pay-as-you-drive model, Telematics device is useful to measure the kilometres driven. But, for Pay-how-you-drive (or Reward-how-you-drive) models, Smartphone is better suited. This is due to its low cost, instant scalability and engagement benefits.

In most personal lines of Insurance, Smartphone based Insurance telematics is a growing trend. With Smartphones growing in capabilities, this trend might speed up in coming years. We wrote a blog on this trend.

For Commercial lines of Insurance, Telematics devices make more sense. Here, Insurance Telematics combines with Fleet management benefits for the Commercial fleet owner. These benefits include Live Tracking, Driving Behavior and Fleet Health monitoring.

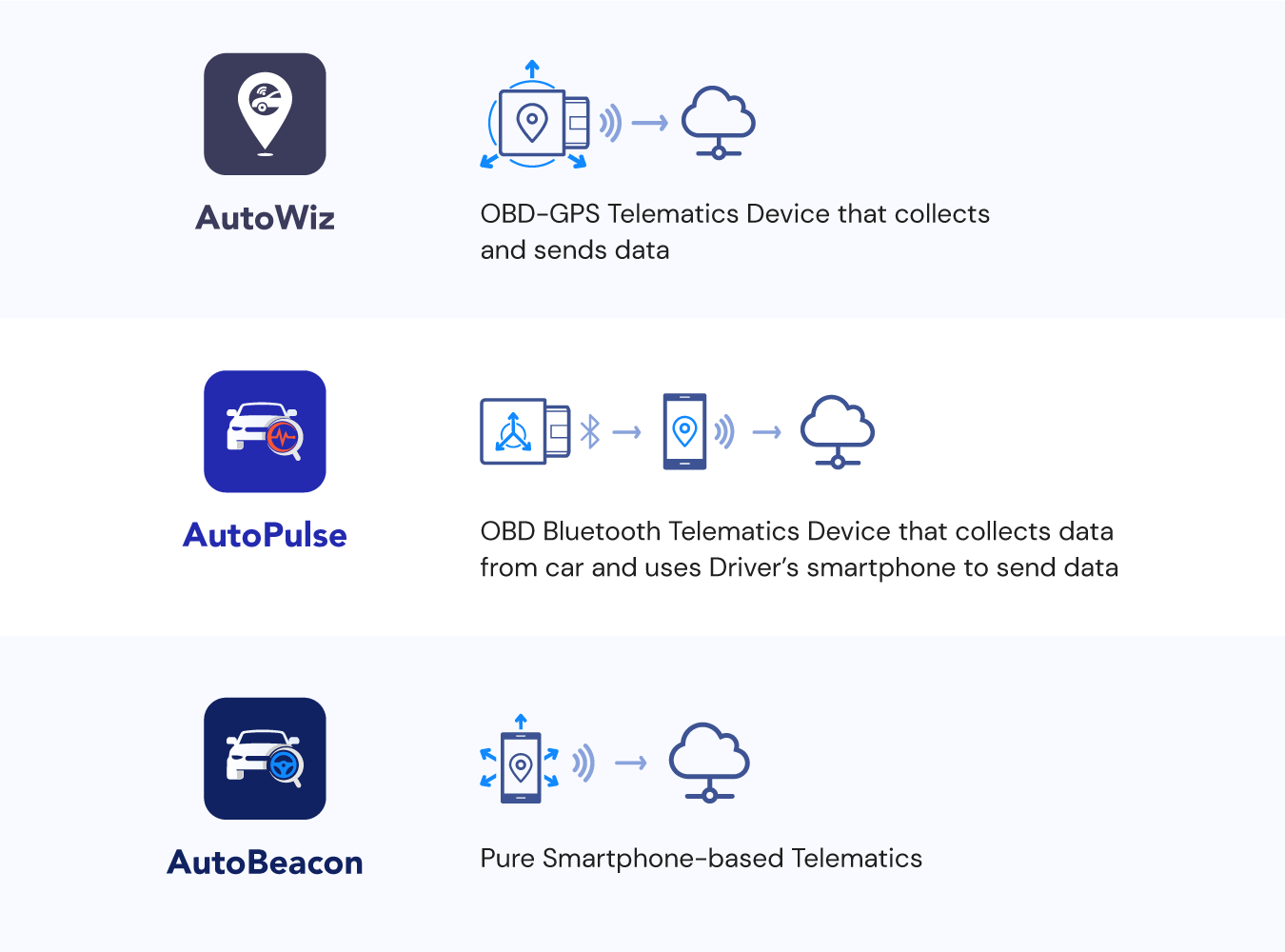

At AutoWiz, we offer several Technology options to Insurers to choose from. These include:

a) OBD-GPS Telematics Device (that collects and sends data independent of Driver’s phone)

b) OBD Bluetooth Telematics Device (that collects data from car but leverages Driver’s smartphone to send data) and

c) Pure Smartphone based Telematics

2. In the era of Connected Cars, new vehicles come with factory (OEM) fitted connected devices. How relevant is it for Insurers to own Telematics?

Newer vehicles often come with factory fitted Telematics devices that OEMs use to offer Connected Car features to car owners. Yet, the current penetration of Connected Vehicles is still a fraction of the total number of vehicles on road. Also, there is no single marketplace for safe exchange of OEM's telematics data across OEMs that Insurers can use. In such a scenario, Insurers need to do one on one agreements with OEM for exchange of data or launch OEM specific Insurance Telematics Programs. This limits the scope and adoption of adoption of the Telematics Insurance program.

OEM fitted Telematics devices might not provide the detailed driving data that Insurers need for PHYD models. As an example, Distracted Driving (lifting of Smartphone for calling/texting while driving) is a growing accident risk. This risk is not captured via OEM fitted devices.

AutoWiz Insurance Telematics solutions can work with different telematics data sources. The include OEM fitted connected devices, OBD dongles or Driver’s smartphones. Irrespective of the data source, our Platform generates a normalized safe driving score that Insurers can use.

3. In my regulatory environment Usage based Insurance is still emerging. Is there any RoI in adopting Insurance Telematics now?

As UBI grows in developed markets, regulators in emerging markets are allowing UBI experiments. In several such emerging markets, its matter of time before UBI goes mainstream. End User surveys show robust demand for such policies.

Early adopters of Telematics Insurance programs get valuable data insights and operational experience. This gives them the lead over laggards when UBI goes mainstream. Telematics Insurance also increases customer engagement, lowers loss ratios and enhances claims experience.

In our view, the benefit of higher customer engagement is quite powerful, though might seem intangible. Insurers are struggling to differentiate in the competitive Auto Insurance space. With Telematics Insurance, they move from a transactional relationship to a value-adding relationship. Currently, Insurers have limited touch-points of Policy renewal (once a year) or a Claim (once in several years ). With Telematics Insurance, the touch points increase to once a week or more via the Insurer's App.

Our Insurance Telematics solutions include aggregated data analytics views for sharper customer segmentation. Our customer analytics engine creates customized insights and rewards for the car owner in the Insurer’s App.

4. Is there evidence to prove that Telematics Insurance helps in reducing loss ratio?

Data from markets such as Italy with wide adoption of UBI show evidence that Telematics reduces the frequency and severity of claims. Also, Safe Driving behavior is a higher predictor of risk as compared to the traditional static predictors like age, car make etc.

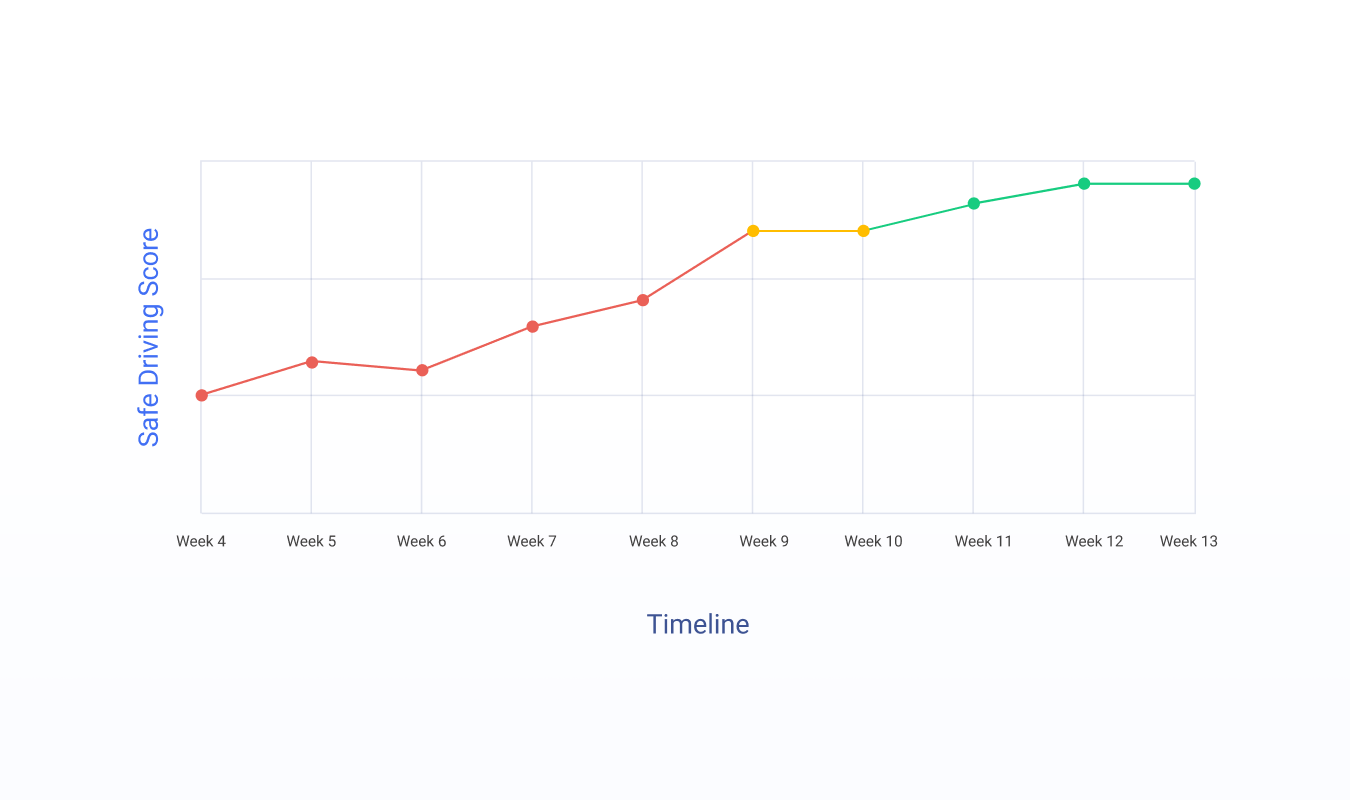

Telematics Insurance makes the driver aware of the areas of improvement and rewards safer driving. This leads to two effects: rash drivers improve driving and safer drivers move towards UBI programs to gain rewards. Both these effects have favorable impact on Loss ratios.

AutoWiz offers Connected Car solution to personal and commercial car owners in several markets. Our data shows a median reduction of unsafe driving behavior by 25% for risky drivers within 8-12 weeks of joining our program. And this improvement sustains over time. Our accurate driving behavior analysis shows specific rash driving instance for each trip of the driver.

5. Will end users be willing to co-operate in the program and share data?

Insurers should design UBI program that is simple, transparent and builds trust with the customer. The program needs to communicate what data is being collected and when. Also, data collection should be as seamless and not need customer to do any specific action.

Our Insurance telematics solutions focus on ease of use and transparency while collecting data. Also, we present clear driving behaviour insights to the user. Our Smartphone telematics solution works in background and uses minimal Smartphone battery. We can configure the solution to work in a higher privacy mode where customer’s location data remains on the phone. Only the driving patterns and driving behaviour insights go to the cloud.

A UBI program that rewards safe drivers while coaching rash drivers on safe driving is likely to have higher acceptance. In comparison, a program that penalises unsafe drivers may see resistance from such drivers.

While designing Telematics Insurance programs, Insurers should focus on the benefits of increased loyalty, lower claims and self-selection of safe drivers. The economic surplus generated from these benefits of Telematics leads to a win-win for both the customer and Insurer.

AutoWiz offers Insurance Telematics solutions to Auto Insurers with multiple technology options as per the goals of their UBI program, including OBD and pure Smartphone-based solutions for Pay-as-you-drive or Pay-how-you-drive models. Our AutoBeacon solution is an advanced Smartphone-based UBI and crash detection solution. It features our accurate driving behaviour monitoring engine (also available as an SDK that can be embedded inside your App) and is affordable for mass-market deployments.